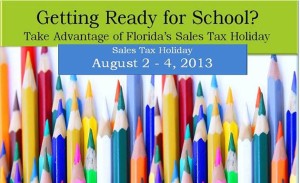

Florida’s back-to-school sales tax holiday will begin at 12:01 a.m., Friday, August 2, 2013, and end at midnight Sunday, August 4, 2013.

During this period, no sales tax will be collected on sales of clothing, footwear, and certain accessories selling for $75 or less, or on certain school supplies selling for $15 or less. Books are not tax-exempt. New this year: no tax is due on computers and certain related accessories selling for $750 or less per item, when purchased for noncommercial home or personal use.

Be sure to check with the retailer before purchasing to ensure the item being purchased is tax free.

“Clothing†means any article of wearing apparel, including all footwear (except skis, swim fins, roller blades, and skates), intended to be worn on or about the human body.

“School supplies†means pens, pencils, erasers, crayons, notebooks, notebook filler paper, legal pads, binders, lunch boxes, construction paper, markers, folders, poster board, composition books, poster paper, scissors, cellophane tape, glue, paste, rulers, computer disks, protractors, compasses, and calculators.

To see a list of clothing and accessory items and their taxable (T) or exempt (E) status during the tax-free period:Â sales_tax_holiday_qa sales_tax_holiday_list_of_items

For general questions:Â sales_tax_holiday_qa